An analysis of the commercial wellness of British business.

In the business world, the last few years have been eventful to say the least. In fact, it’s hard to remember a time when there’s been such uncertainty in the markets, for such a prolonged period of time. This, combined with unprecedented pressure on a number of key industries, including retail, automotive and travel, has led to some of the country’s most iconic brands going out of business. And with our departure from the EU yet to happen, we’re not through the storm yet. Yet throughout 2019, the UK economy remained in a state of – albeit modest – growth, while 2020 forecasts are only slightly behind the Bank of England’s long-term trend rate.

Against this challenging – and sometimes confusing – context, we hear often conflicting accounts from business leaders of the state of UK business, with individual’s views more often than not informed by their respective political leanings.

So, what is the reality, and what is the mood amongst those businesses operating at the coalface?

Understanding these types of issues are key to us at Huthwaite International. The UK is packed with ambitious and prosperous companies that, in theory, should flourish regardless of economic uncertainty. However, the importance of effectively leading those businesses and making the right decisions, not to mention obtaining core skill sets such as sales, negotiation and communication, shouldn’t be underestimated.

To help us better understand this current reality, we have commissioned a bench-marking study in conjunction with OnePoll into the commercial wellness of UK business.

The report, which questioned more than 1,000 UK business owners and senior managers, is fascinating and explores not only which industries are currently prospering, but where the pressure points are on businesses, as well as their respective strategies to cope and mitigate against such challenges. And yes, the report couldn’t avoid the topic of the last three years; Brexit; with some fascinating insight.

But what’s most important is that the findings of our study are straight from the horse’s mouth; it was completed anonymously, by a broad cross section of industry, without political context, making it all the more credible and insightful.

Tony Hughes, CEO of Huthwaite International.

The bench-marking report sought views from those working across 28 different UK industry sectors including, but not limited to; finance, manufacturing, healthcare, construction, transport, logistics and IT. The data was then further broken down by region, giving us a clear picture into the attitudes and challenges across the country as a whole.

This first part of the report set out to take a snapshot into how senior leaders feel at this moment in time when it comes to confidence in their own business. The report delves deeper, exploring what specific pressure points they are currently facing, and what practical coping mechanisms they are employing to navigate their respective challenges. This first section serves as a ‘line in the sand’; establishing the mood in the business world right now, before we go on to look further ahead, later in the report.

One of the most telling pieces of insight from the study was around which industries are currently feeling confident when it comes to the growth and success of their business at this moment in time. Despite the well-publicised challenging economic climate, almost all respondents stated that they felt confident about their business growth in the short term, with, on average, 69% claiming they were some-what to very confident. On average, just 13% felt some-what to extremely un-confident about this issue.

Coming top of the pile were those operating in the ‘commodity’ industries of Energy and Utilities (89%). However, despite media reports to the contrary, engineering and manufacturing (80%) came joint second with environment and agriculture (also 80%). This is perhaps surprising given the latter two are both industries firmly in the ‘Brexit spotlight’, yet clearly this does not seem to be significantly denting their confidence.

Regionally there was some variation. Perhaps predictably, London emerged as the most buoyant part of the UK with 78% of business leaders feeling confident about their business growth at this moment in time.

However, rather than a clear North/South divide as one might expect, the rest of the country is also well-represented, with Manchester emerging as the second most confident region (76%) followed by the West Midlands (75%). The duo is not entirely surprising given all locations are well-established business destinations.

At the other end of the scale are those who are least confident about the state of their business when it comes to growth at this moment in time. Coming bottom were those operating in the East of England (21% felt un-confident), Northern Ireland (19%) and Wales (16%).

Finally, women emerged with a more bullish outlook, with 75% claiming they felt confident about the prospects of their business at this moment in time, in contrast to 67% of men.

Despite many industries feeling confident about their respective growth potential, post-Brexit we see some concerns for the future, which has a clear and direct impact on overall confidence levels. In fact, we see confidence levels drop by 20% when it comes to business growth prospects post-Brexit, with 60% of all business leaders somewhat to very confident about the growth of their business.

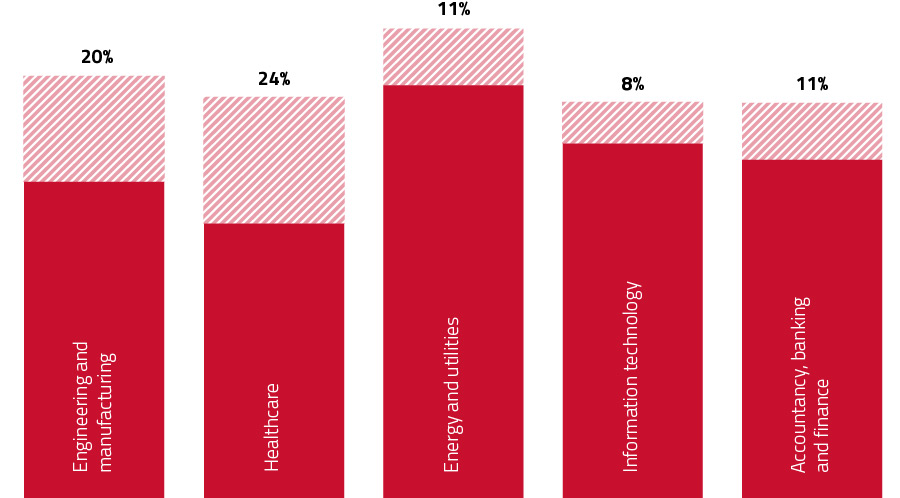

We also see a marked drop in confidence from almost all sectors when comparing how they feel today, with their confidence post-Brexit. The biggest drops in confidence are from those operating in engineering and manufacturing (20% drop), healthcare (16% drop) and energy and utilities (11% drop).

Despite this, the sectors which remain most confident overall – albeit, less confident than before the post-Brexit period, are again; energy and utilities (70%), as well as IT (67%), and accountancy banking and finance (64%).

The one sector that could possibly benefit from Brexit, is creative arts and design, which is the only industry to see an increase in confidence from ‘today’s’ levels to a post-Brexit time frame.

Finally, certain sectors are facing seemingly troubled times. ‘Public Services and administration’, ‘performing arts and leisure’, ‘sport and tourism’ all ranked low on confidence, both now and in the post-Brexit world.

Respondents were asked about their biggest business concerns, now, and post-Brexit.

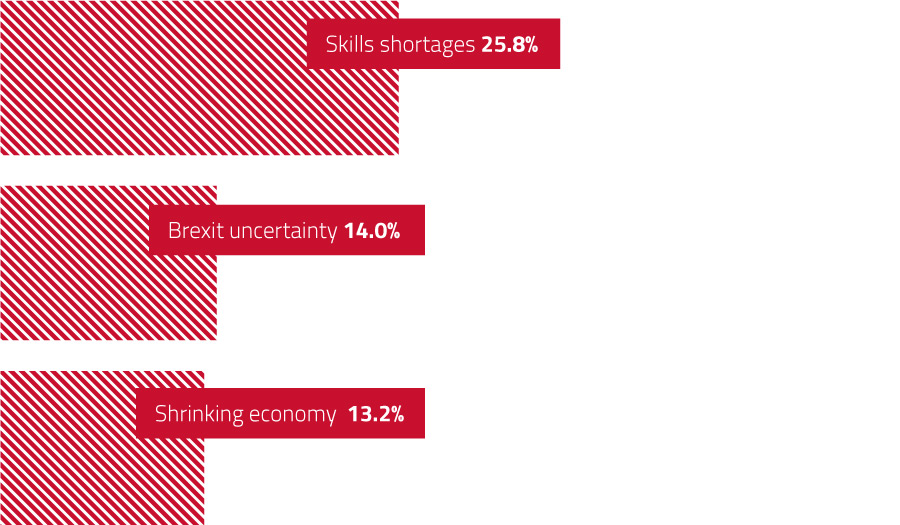

Brexit uncertainty ranked as the highest current business concern people were facing (43% of respondents), coming above issues such as skills shortages (14%) or the economy going into recession (10%). However, when asked the same question, but in the post-Brexit future, five years from now, we see skills shortage emerging by far top (26%), perhaps a reflection of fears surrounding the ability to attract the best European talent to the UK.

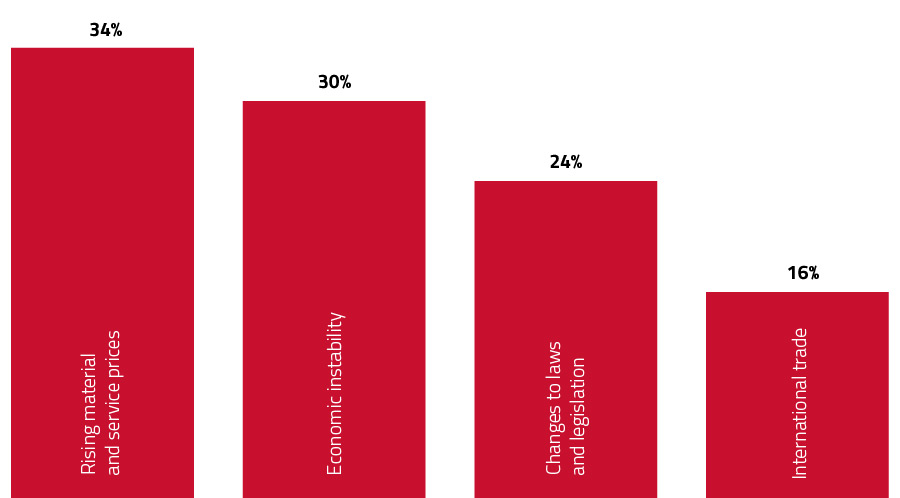

The survey also asked business leaders specifically what their biggest concerns were when it came to trading in a post-Brexit world. Rising prices when buying in materials and services (34%) emerged as the top concern, as business owners fear their profit margins taking a hit as their operating costs increase. Perhaps unsurprisingly, economic instability came second (30%) followed by changes to laws and legislation (24%), and challenges facing trading internationally (16%).

Clearly then, there are some serious concerns about what the post-Brexit business world will look like. Not only does business confidence take a hit, but there are some specific areas that business leaders are concerned about, not least the very real risk of a skills shortage, as well as increasing costs when it comes to buying in goods and services.

In order to offer some kind of ‘antidote’ to these challenges, the bench marking survey asked respondents what specific strategies they planned to put in place (or invest more time and money in) in order to effectively grow their businesses and tackle these issues head on.

Somewhat surprisingly, overall, ‘employing more staff’ emerged as the top priority (33%), followed by looking at a way to negotiate on existing contracts (33%) – perhaps a reaction to people’s concerns about prices increasing post-Brexit. Also making the list were investing in sales training (26%), and investing in new machinery or equipment (21%).

Rather worryingly, 24% of business leaders claimed they ‘didn’t know’ what they needed to do in order to drive growth.

When it comes to post-Brexit negotiation, 41% of respondents recognised the need to create new negotiation processes, or change their existing approach to negotiation, in order to thrive. Just over a quarter (26%) claimed their current negotiation processes were sufficient, while 23% asserted that negotiation is not a skill they need in order grow.

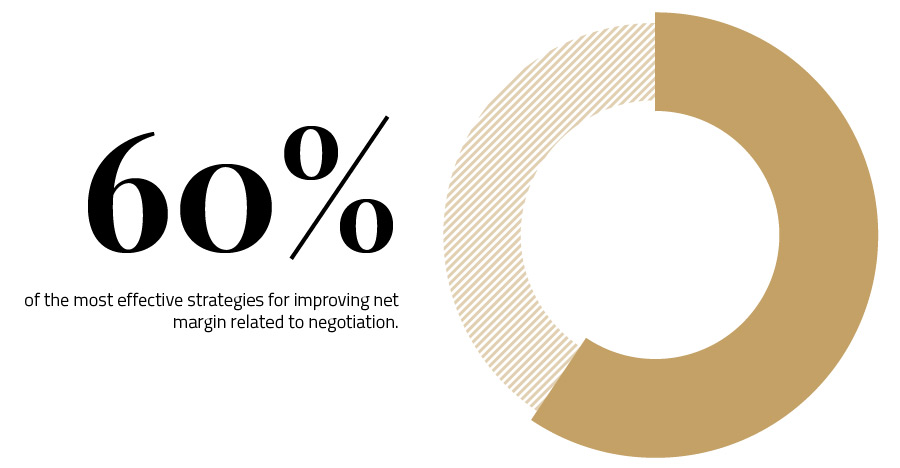

At this point, it is useful to examine a previous piece of research conducted by Huthwaite International through research partner, YouGov, that investigated the top business strategies from those in a leadership capacity, when it comes to improving their company’s net margin.

The following list outlines the top 10 approaches;

Fascinatingly, 60% of the most effective strategies related to negotiation, showing the strategic importance of this business tool when it comes to growing a business and driving profitability.

The same research explored the link between those companies with a systematic approach to negotiation, and those without, against their respective company performance over the past financial year.

As well as present day and short term (post-Brexit) forecasts, the study also sought to discover business leaders’ views on the performance of their organisations in the medium-long term, up to 10 years into the future.

Overall, the vast majority (71%) of leaders felt somewhat, very confident in the success and growth of their business in this time-frame. This is an improvement on both the immediate post-Brexit forecast (60% confidence), and the ‘how you feel today’ bench-marking forecast (69% confidence) at the start of this report, indicating that an improvement in confidence is – eventually – anticipated.

The usual suspects emerged as most bullish; Energy and utilities (85%); IT (74%); and accountancy, banking and finance (72%).Business leaders were asked about their different anticipated business challenges in the future, from increasing turnover to growing international trade opportunities. They were asked to indicate how confident they were of their company’s ability to deliver in each area in the future. The areas receiving the most optimism were retaining staff, winning new clients and contracts, and continuing to grow company profit. More than half (56%) indicated they were optimistic when it came to expanding their company, while 46% were confident of growing their business overseas.

Interestingly, when it comes to the biggest business concerns in ten years’ time, ‘skills shortages’ remains top.

The role of data in virtually every industry is well known, and the survey supported this, identifying that 74% of businesses are using data in some capacity to improve company performance in some form.

However, despite already recognising the importance of sales as one of the solutions to the current business challenges they face, a significant 64% overlook the potential data insight has to offer when it comes to developing a sales strategy.

The study is fascinating, and while it is based on forecasts rather than financial figures, it paints a compelling picture into the challenges we could face in the years to come.

Clearly Brexit casts a long shadow over UK businesses, with many fearing an imminent skills shortage, as well as increasing prices set to put pressure on margins.

Driving growth comes down to a multitude of factors, but all businesses need to sell something, and one of the few certainties the UK faces is that, for selling organisations, things are going to get tougher. As buying organisations entrench, delaying or even cancelling purchasing decisions, sales teams across all sectors and markets are having to up their game.

Despite all this there remain an alarming number of business leaders who simply do not see the value in learning and development. We know that nearly half of business leaders don’t have a systematic approach to negotiation across every department, while just 26% of business owners invest in sales training for their teams. But perhaps even worse is the 24% of business leaders identified in this survey that claimed they had no idea how they could drive growth within their own operations.

So, while we can’t predict the future, we can prepare for it, and the growth and success of companies up and down the UK will surely be defined by just how ready we are. While confidence on its own might be able to grow a business in the short term, it is investment and a focus on core skills, such as sales and negotiation training, that will in the long term.

To discover how Huthwaite International can help to future-proof your business ahead of Brexit, speak to a member of the Huthwaite team and learn more about the timeless methodologies used to help bolster commercial growth amongst the globes leading companies.

Huthwaite International

Harry Brearley House

6 Fox Valley Way

Fox Valley

Sheffield

S36 2AE

+44 (0)1709 710081

enquiries@huthwaiteinternational.com

Copyright 2024 Huthwaite International | All Rights Reserved Huthwaite International | Change Behaviour. Change Results.™